The phrase ‘All roads lead to Rome’ is a way of expressing that there are many ways of doing something that may all ultimately lead to the same achievement. This rings true in the world of investment management and building portfolios.

Conclusion First:

There are many different ways to build a well-diversified portfolio which should, in theory, get you close to the same achievements over the long-term as other well-diversified portfolios. The difference is which investment vehicles are used and the reason why they are used.

In my

Asset Allocation

post I discussed the ways in which you can divide up your portfolio to become diversified between assets classes and sectors. In this post, we are going to discuss the different investment vehicles one can use to get that asset allocation.

Momentum Private Wealth Management uses a combination of Individual Stocks, No-Load Active Managed Mutual Funds and Exchange Traded Funds, or ETFs, to build our portfolios. I will discuss each type of these investment vehicles below.

Individual Stocks

In most of our portfolio strategies, MPWM allocates a ‘Core’ portion of the portfolio to individual stocks, more specifically, mostly blue-chip, large-cap U.S. companies. We do this to gain a targeted approach to companies we feel are well positioned to have positive returns over the long-term and we desire more exposure to them. This portion of the portfolio may have anywhere from 20-40 individual stocks at any given time. To be clear, this is NOT a ‘active, day-trade’ part of the portfolio. We believe in a long-term approach and you may find you hold some of these positions for many years.

Active Mutual Funds

You may have heard the terms ‘Active’ and ‘Passive’ when researching mutual funds and wondered exactly what that means. First, let us define a mutual fund:

- Mutual Fund: an open-ended investment fund that uses pooled money from investors to buy individual investments, including stock and/or bonds.

To keep it simple, a mutual fund is a basket of investments purchased by many different people pooling their money together. You share in the gain or loss of the investments. If you invest in a mutual fund, you are given shares of that fund, which represent the portion of your invested money.

- Active mutual funds have a manager or a team of managers that actively buy and sell investments for the mutual fund. They design an investment policy, or

Pros:

- Diversification- By pooling investor money together, the mutual fund is able to purchase many more stocks and diversify more than you would be able to on your own.

- Easy- You sit back and let the professionals do the work

Cons:

- Fees- active mutual funds have fees associated with them called the Expense Ratio. Usually these are anywhere from 0.10% to upwards of 3% for more exotic mutual funds!

- Fees- Some mutual funds also charge ‘loads.’ These can either be front-end sales charges (when you buy) or back-end (when you sell) and can be hefty. MPWM does not utilize mutual funds that charge ‘loads.’

Trading Note: Mutual Funds (both passive and active) do not trade intra-day like individual stocks or ETFs do. They are priced once a day at the close of the market.

Passive Mutual Funds

Passive mutual funds are almost identical to active mutual funds except for two major differences:

- Passive funds have no active manager. They are designed to replicate and mimic a certain part of the market. For example, an S&P 500 passive fund will simply mirror the S&P 500 index. These funds, by definition, should perform exactly as the index would.

- Fees- because there is no active manager that needs to be paid, the fund can operate on a limited expense ratio. These are typically 0%-0.10% but can be higher depending.

Pros:

- Diversification- very well diversified based on fund objective

- Fees- Very inexpensive way to gain access to large parts of the market

Cons:

- Performance- expect the fund to mirror the performance of the objective it is mirroring.

Exchange Traded Funds

Keeping it high level, Exchange Traded Funds or ETFs operate very similarly to passive mutual funds except for how they are traded. Instead of being priced once a day after the close of market, ETFs are traded intra-day like individual stocks. They can even trade at a premium or discount to their underlying value.

Pros:

- Intra-day trading- You can buy or sell throughout the trading session.

- Diversification- you can find an ETF to replicate almost any type of the market you wish. For example, one major ETF provider has 370 different ETFs you can trade on in the U.S. market.

- Fees- Broad market ETFs usually have a low expense ratio of around 0.10% but can be higher depending on exposure.

Cons

- Like passive funds, ETFs are not actively managed.

Momentum Portfolios

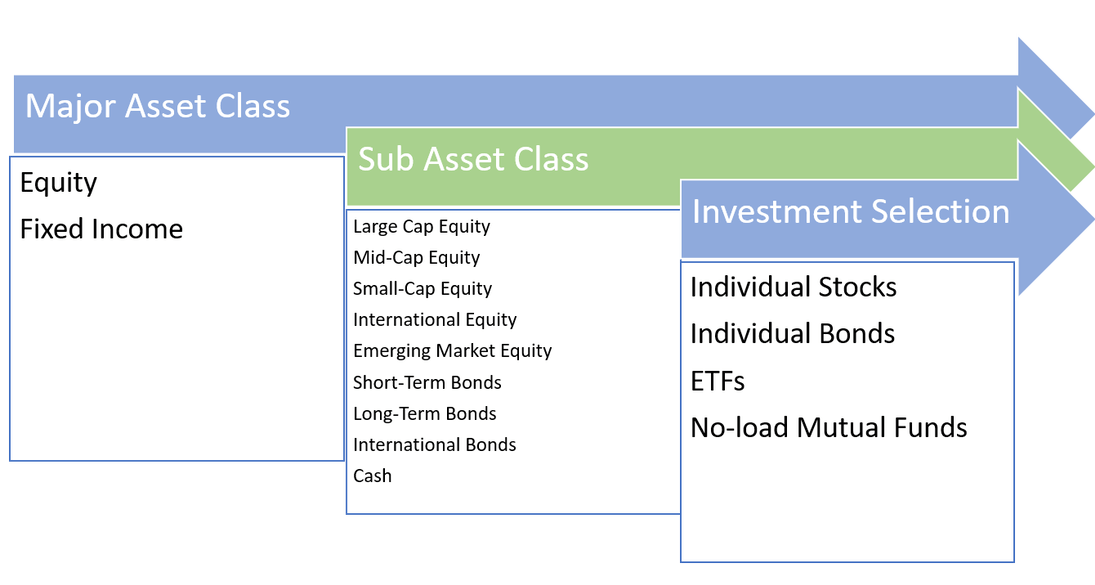

Now that we have discussed the main types of investment vehicles, I will explain the methodology behind Momentum Private Wealth portfolios. As the chart below explains, from my Investment Approach page, I start with major asset class exposure, then sub-asset class exposure with sectors, then I choose which vehicles I want to provide that exposure.

I then allocate my core individual equity portfolio of stocks that fall mostly in the Large-Cap Equity space. Once I have that, I build out the rest of the portfolio using active no-load mutual funds and ETFs. I prefer using ETFs over passive funds but reserve the right to use them in the future, of course.

The main reason I use mutual funds and ETFs for most of the portfolio is efficiency. Once you get into the small-cap or international equity space, its much harder to research and pick individual stocks AND then trade them on foreign markets. It makes the most sense to let the professionals do that for us.

The Next Step

- Do you know how your portfolio is currently allocated?

- Do you know how much you are paying in expense ratio fees across the entire?

- Are you interested in learning more about our portfolios?

If you answered ‘no’ to either of the first two questions and ‘yes’ to the last, it is time for you to take action.

Reach out to Momentum Private Wealth today.

We are able to provide you a complimentary portfolio analysis, using third-party software, that will provide you a detailed analysis of your current portfolio to determine if your asset allocation and exposure is appropriate for your desired risk level.

Building a portfolio does not have to be rocket science, but it is important to be aware of your allocation by asset class, sub-asset class and overall expenses. A well-diversified and monitored portfolio is a major tool on your path to financial freedom -

Reach out to MPWM today.

If you are not having frequent conversations with your wealth or investment advisor about market strategies, investment management, or financial planning opportunities, you should be, especially in a market like this!

Momentum Private Wealth Management

specializes in Wealth Management as well as Comprehensive Financial Planning. Feel free to reach out to Austin directly at 512.416.8085 or austin@momentumpwm.com. You can also find out more information about MPWM at:

www.momentumpwm.com

.

You can also read more about Austin on his

LinkedIn Page

,

CFP® Professional Certificate Page

, his

NAPFA Page

or on his

XY Planning Network Profile page.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Momentum Private Wealth Management, LLC (referred to as “MPWM”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

MPWM does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MPWM be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if MPWM or a MPWM authorized representative has been advised of the possibility of such damages.

In no event shall MPWM have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.