At the end of every calendar year a low rumble starts to build in investment firms across this nation. You might not hear it, but the buzz starts to grow louder and louder in November with a crescendo sometime around mid-December. This idea is where ‘Growing client portfolios to the best of our ability’ and ‘selling losses to help save on taxes’ converge. Yes, I am talking about Tax Loss Harvesting .

Executive Summary:

- You may be able to sell portfolio losses to offset any realized portfolio gains and potentially save in Federal taxes

- Be wary of the IRS Wash Sale Rules

- Do not let the “Tax-Tail wag the Investment-Dog.” In other words- do not intentionally misallocate your investment portfolio to try and save a minimal amount in taxes. Talk to your Investment Advisor or Tax advisor before implementing a strategy.

The purpose behind tax loss harvesting is simple: if you have REALIZED gains in your TAXABLE portfolio, then you might be able to offset those realized gains with realized losses, thereby saving yourself some taxes. This concept is simplistic however there are parameters on how this works. First, you must determine whether your account can even be used for tax-loss harvesting, then you will offset but you must be aware of the Wash Sales rules.

Account Types

Taxable Accounts- These are your typical brokerage accounts that are not IRA accounts or retirement accounts. The titling might be Individual, Joint, JTWROS which stands for Joint with Rights of Survivorship, Revocable Trusts, Community Property, etc. These accounts all produce tax forms at the end of the year called 1099s.

These are the account types where you can utilize tax-loss harvesting

.

Tax-Deferred Accounts- These are your typical Traditional IRA accounts, 401(k)s, 402(b)s etc. You are only required to pay taxes (and possibly penalties) on any amount that is removed from the account. You cannot utilize tax-loss harvesting in these account types.

Tax-Exempt Accounts- Primarily comprised of ROTH IRAs. If properly utilized, ROTH IRAs allow tax free growth of your gains. You cannot utilize tax-loss harvesting in these account types.

A simplistic example of how to offset a gain

Say you bought XYZ mutual fund for $10,000. Due to market conditions, the value of XYZ fund is now $12,000- an unrealized gain of $2,000. You decide to then sell XYZ Fund. Your now realized gain for tax purposes is $2,000 (Current Value- Cost Basis= Gain)

Now say you also bought ABC mutual fund for $10,000 but the current market value is only $8,000. The unrealized loss is $2,000 and you decide to sell the fund, turning the loss into a realized loss. (Current Value- Cost Basis= Loss)

Now you have a realized gain of $2,000 and a realized loss of $2,000 which then offset and nets you a realized gain of $0.

The above example is basic and outlines the general concept of tax-loss harvesting, but there are further IRS rules you must consider.

Netting and offsetting your gains and losses

You might remember that there are long-term gains and losses and there are short-term gains and losses. Long-term gains are taxed more favorably than short-term gains. The timeline for differentiating between the two is if the time (also called the holding period) between buying the asset and selling the asset is greater than 1 year, then the gain is considered long-term. If less than 1 year, the gain is short term.

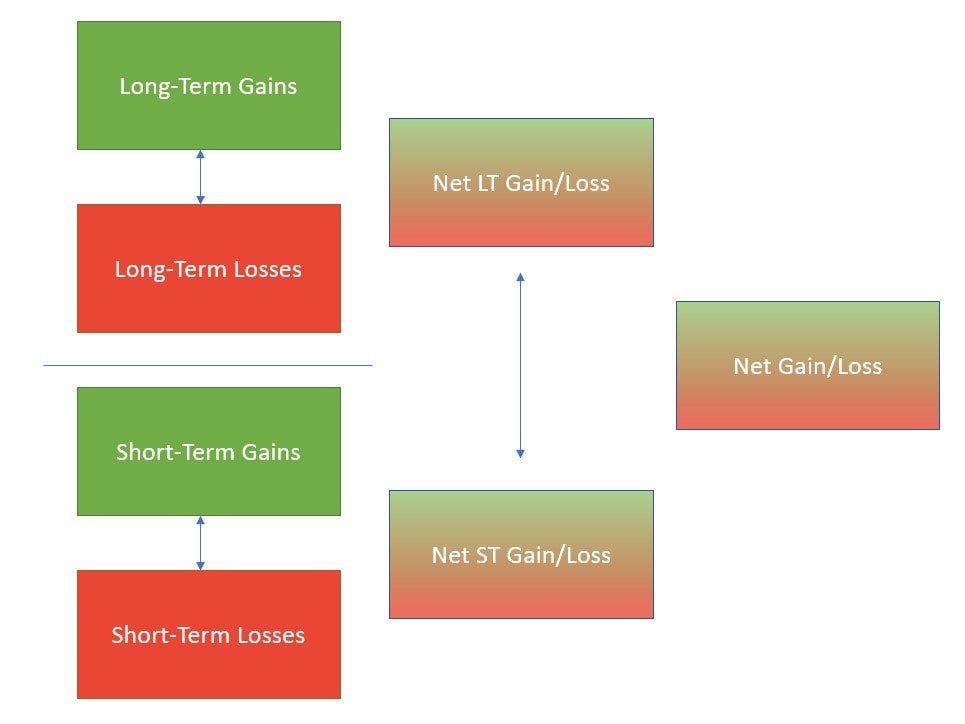

Why is this important? Well, when you decide to sell an asset for a loss to offset a gain, you must consider if the gain is long-term or short-term and whether the loss is long-term or short-term. The following over-simplified chart explains the offset rules:

You must first offset like gains to like losses. Then, you offset the net from each if you can, to arrive at your net gain or loss. If you have a net loss, you then might be able to offset up to $3,000 of ordinary income and carry the loss forward to future years. That topic is not fully discussed in this piece.

Wash Sale Rule

The IRS has a rule called the Wash Sale and it is straightforward. You cannot sell a security at a loss and then repurchase the same or ‘substantially identical’ security within 30 days before or 30 days after the sale. Simply put, you cannot sell ABC mutual fund for a loss to realize the loss, then buy it back the next day so you keep your portfolio intact.

This brings up an important discussion point to have with your advisor. Is the potential tax savings enough to override the shift your portfolio allocation will take in implementing loss harvesting? The answer is not always a yes, and you should not let the tax-tail wag your investment dog.

Is Loss-Harvesting something you should consider?

If you think you might benefit from tax-loss harvesting, you should talk to your financial professional. Sometimes a portfolio has no losses to take! Sometimes there are few realized gains to offset. Either way, you should partner with a trusted professional to make sure any potential tax savings that might be available to you are not overlooked.

If you are not having frequent conversations with your wealth or investment advisor about market strategies, investment management, or financial planning opportunities, you should be, especially in a market like this.

Momentum Private Wealth Management

specializes in Wealth Management as well as Comprehensive Financial Planning. Feel free to reach out to Austin directly at 512.416.8085 or austin@momentumpwm.com. You can also find out more information about MPWM at:

www.momentumpwm.com

.

You can also read more about Austin on his

LinkedIn Page

,

CFP® Professional Certificate Page

, his

NAPFA Page

or on his

XY Planning Network Profile pag

e

.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Momentum Private Wealth Management, LLC (referred to as “MPWM”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

MPWM does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MPWM be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if MPWM or a MPWM authorized representative has been advised of the possibility of such damages.

In no event shall MPWM have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized

.