In recent years, a select group of tech giants, often referred to as the "Magnificent 7," has come to dominate the S&P 500, the leading index of U.S. large-cap stocks. This elite group typically includes Apple, Microsoft, Amazon, Alphabet (Google), Meta Platforms (formerly Facebook), Tesla, and NVIDIA. These companies have experienced tremendous growth, driven by technological innovation, market dominance, and global reach. However, their significant weight in the S&P 500 raises concerns about concentration risk, particularly for investors with an overweight exposure to these stocks. In this blog post, we explore the impact of the Magnificent 7 on the S&P 500 and the potential risks associated with concentrated exposure.

The Magnificent 7's Weight in the S&P 500

The S&P 500 is a market-capitalization-weighted index, meaning that larger companies have a more significant impact on the index's performance. As of mid-2023, the Magnificent 7 accounted for a substantial portion of the S&P 500's total market capitalization. This concentration is a result of their massive market values, which collectively amount to several trillion dollars. For instance, Apple alone has a market capitalization exceeding $3 trillion, while other members like Microsoft and Amazon also boast valuations in the trillions.

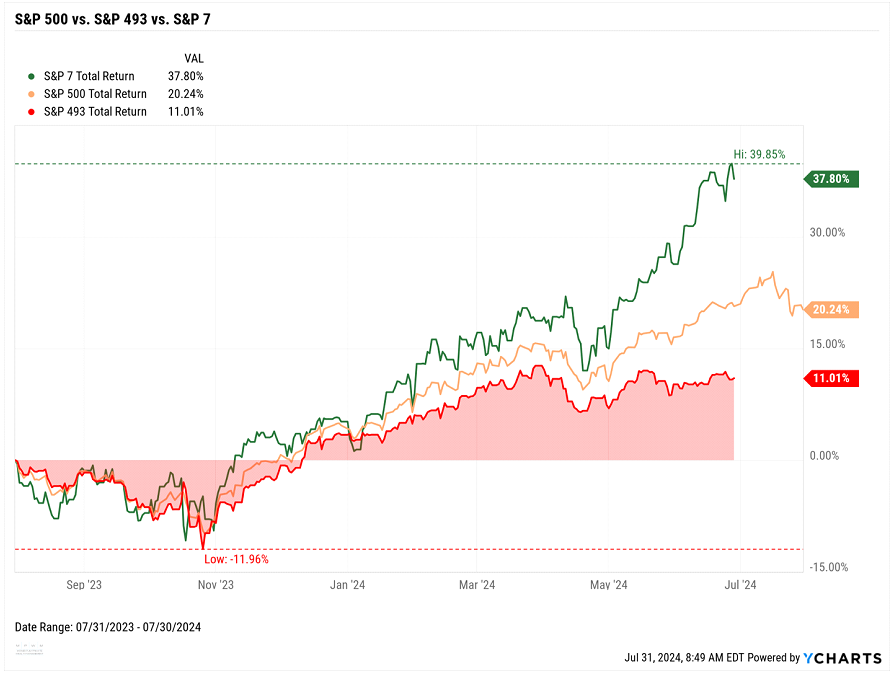

The dominance of these seven companies is notable: they represent over 25% of the S&P 500's total market capitalization. This concentration is unprecedented, as historically, no single group of companies has held such a substantial weight in the index. The sheer size of these firms means that their stock price movements can significantly influence the overall performance of the S&P 500, overshadowing the impact of the remaining 493 companies in the index.

Source: YCharts

The Risks of Overweight Exposure to the Magnificent 7

1. Concentration Risk:

Concentration risk arises when a portfolio is heavily weighted toward a small number of assets, sectors, or factors. With the Magnificent 7 constituting a significant portion of the S&P 500, investors who are heavily invested in these stocks or index funds that mirror the S&P 500 may face heightened concentration risk. This risk is particularly concerning because it ties the performance of a substantial portion of a portfolio to the fortunes of a few companies. If these companies were to face adverse developments—such as regulatory scrutiny, slowing growth, or technological disruption—the impact on the portfolio could be disproportionately large.

2. Valuation Concerns: The Magnificent 7 have enjoyed high valuations, often justified by their strong growth prospects and dominant market positions. However, high valuations can also signal increased risk. These companies are priced for perfection, meaning any negative news or failure to meet market expectations can lead to significant stock price declines. The higher the valuation, the more sensitive the stock price is to changes in earnings expectations or broader market sentiment.

3. Sector Risk: Although the Magnificent 7 are involved in diverse industries, they are predominantly technology-focused. This concentration exposes investors to sector-specific risks. For example, changes in technology regulations, data privacy laws, or shifts in consumer preferences can disproportionately affect these companies. Moreover, technological disruption, while a growth driver for these firms, also poses a risk if new competitors emerge or if innovation slows down.

4. Market Dynamics and Systemic Risk: The Magnificent 7's influence extends beyond the S&P 500, impacting the broader market and investor sentiment. Given their size and weight in major indices, movements in these stocks can affect the overall market's performance. This can create a feedback loop where market trends are amplified, increasing volatility. Additionally, systemic risks, such as a market-wide tech sell-off or macroeconomic downturn, could disproportionately affect portfolios heavily weighted in these stocks.

5. Diversification and Portfolio Balance: A key principle of prudent investing is diversification—spreading investments across various assets to reduce risk. While the Magnificent 7 have delivered impressive returns, relying too heavily on them undermines this principle. A well-diversified portfolio includes a mix of asset classes, sectors, and geographies, which helps mitigate the impact of adverse events in any single area. Overweighting in a narrow set of stocks compromises this balance, exposing investors to potentially sharp declines if these companies underperform.

Conclusion

The Magnificent 7's outsized influence in the S&P 500 highlights a broader trend in market concentration, reflecting the significant role of technology in the modern economy. However, this dominance also brings risks, particularly for investors with overweight exposure to these stocks. Concentration risk, high valuations, sector-specific vulnerabilities, and potential systemic impacts underscore the importance of diversification and careful portfolio management.

Investors should regularly assess their portfolio allocations, considering the risks associated with heavy exposure to a few dominant stocks. While the Magnificent 7 may continue to lead market growth, a balanced and diversified investment approach remains crucial for managing risk and achieving long-term financial objectives.