INVESTMENT APPROACH

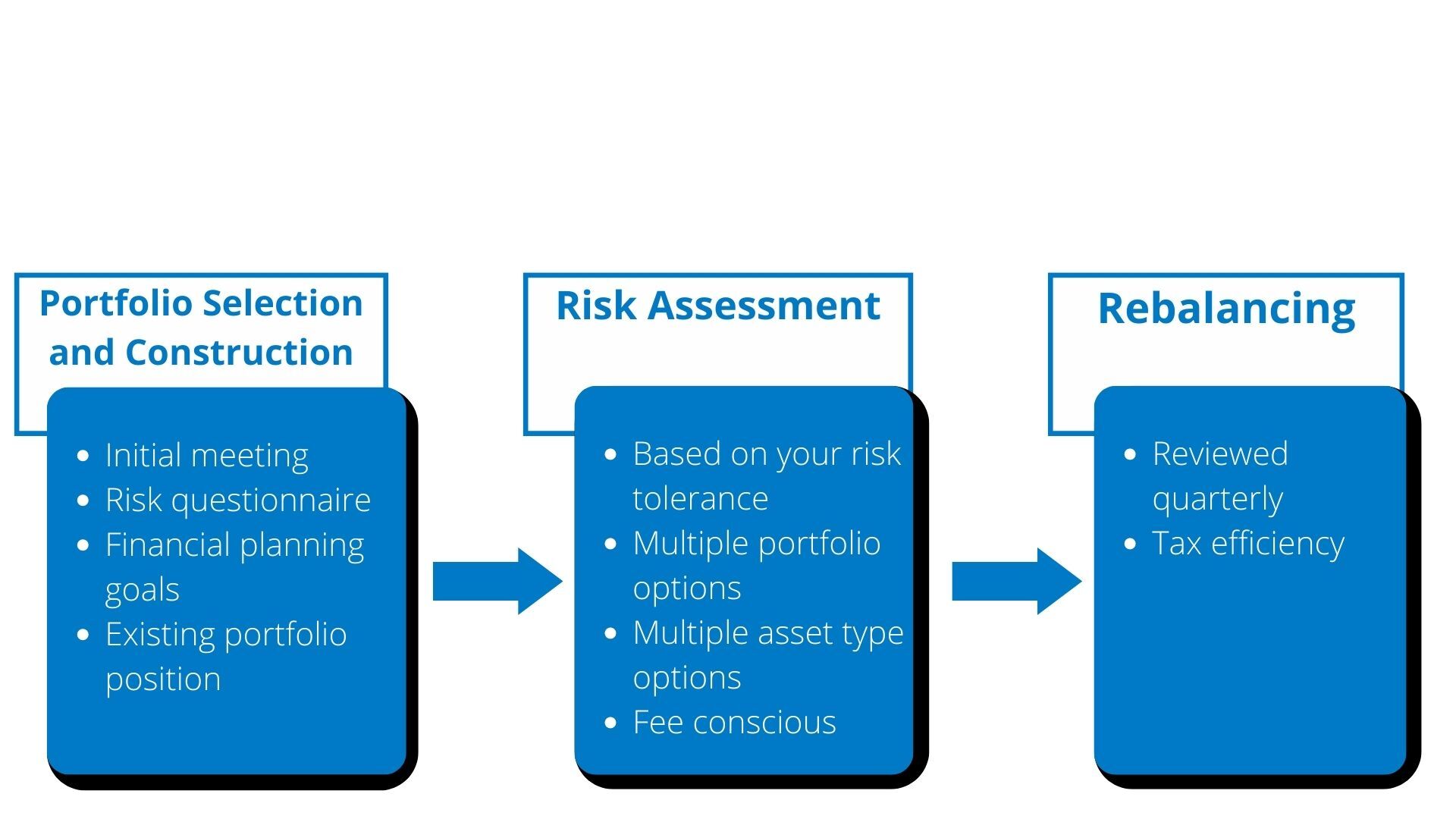

Momentum Private Wealth Management utilizes a three-step process for all of our clients’ investments:

Understanding & Defining

Your Risk Tolerance

We work to unravel your risk tolerance through our risk questionnaire, your financial planning goals, and even our initial discussions with you. These things can help us determine the amount of risk you view as appropriate when it comes to building your portfolio.

If you will be managing your wealth with a spouse or partner, it’s important to come to an agreement as a pair. Often, compromises must be made.

Selecting &Building Your Portfolio

Now that we understand how much risk you are willing to tolerate in your portfolio, we can help you find options that suit your needs. We construct an entire portfolio from a range of those options utilizing Socially Responsible Investing (SRI) standards. For example, your investment portfolio may include a mix of stocks, bonds, ETFs, and no-load mutual funds, and you can also customize it in any way you see fit.

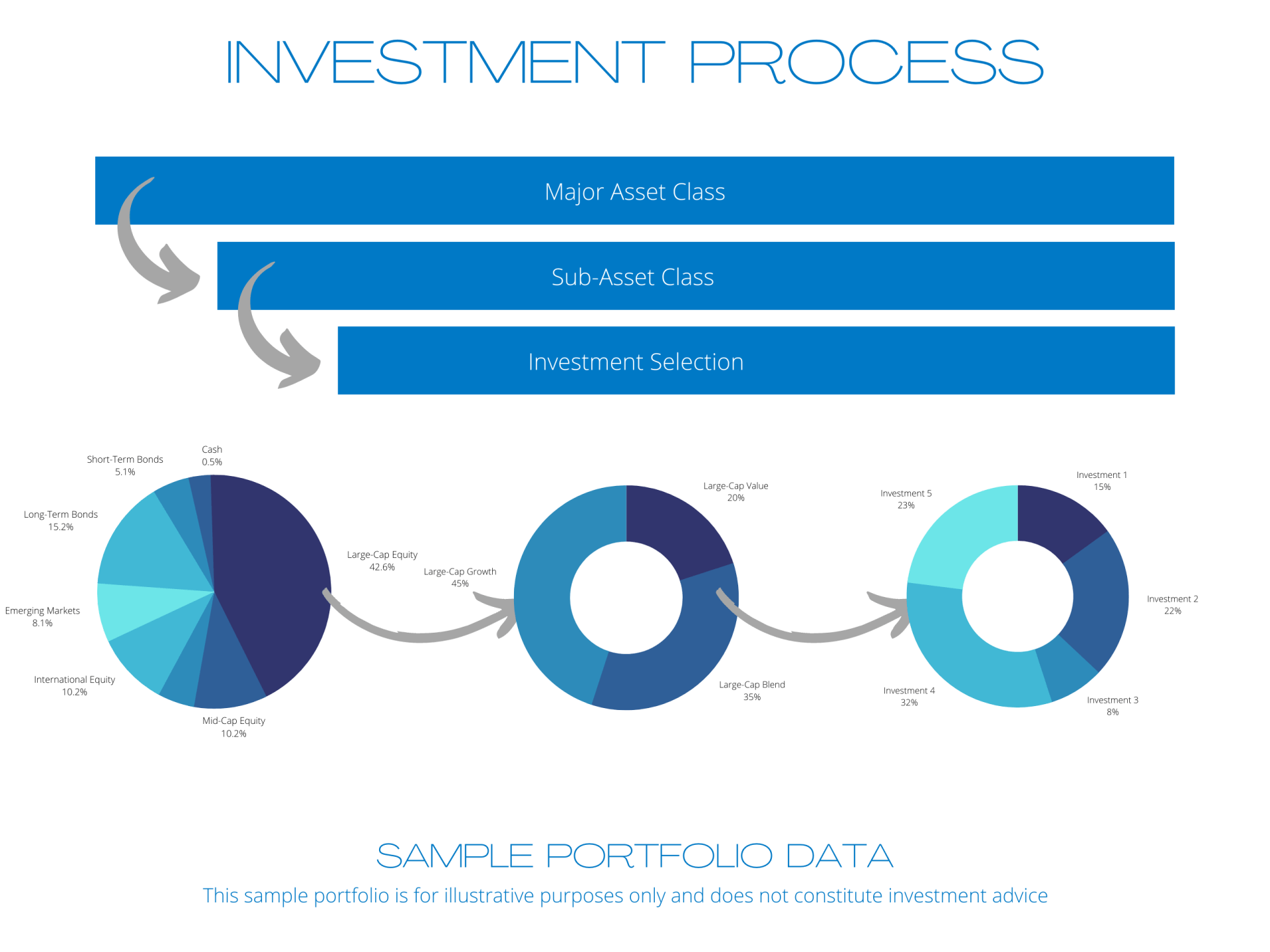

Our portfolios are intentionally constructed to be fully diversified. We start by identifying your equity/fixed income allocation based on your risk tolerance, then we work our way down through the sub-asset classes, sectors and geographical location of investments.

Monitoring & Rebalancing

Your Portfolio

Putting together a portfolio isn’t the last step in the process. In fact, we will continue to work with you to monitor and rebalance it as your investment needs or the markets change.

We rebalance every portfolio at least once each quarter, and we always keep factors like tax efficiency and trading costs in mind during these rebalances.

The process of building the portfolio begins with the major asset class proportion, then sub-asset class selection proportion, then ultimately the individual holding.

Risk is defined as the uncertainty of a return and the potential for capital loss in your investment. Past performance is no guarantee of any future return. No investment or financial planning advice may be rendered until an investment management and/or financial planning agreement is in place.

MWPM is a Fee-Only Registered Investment Advisor and is acting as a Fiduciary to it's clients. This means that we do not accept commissions from anyone nor do we sell any product. We simply offer advice and investment management based upon what is right for you, the client. We take the term 'Fiduciary' seriously, and so should you.

Our office serves the entire Austin Texas area, including:

Austin, Cedar Park, Georgetown, Leander, and Round Rock.

All Rights Reserved | Momentum Private Wealth Management

Website by EGS Marketing Solutions